Swap it like it’s hot.

Finally, NachoSwap is live and the next step to building an ecosystem has begun.

NachoSwap has arrived, not a moment too early. As the second major milestone on our roadmap, the whole Nacho Finance team has been working tirelessly to launch our very own DEX. It’s finally here, a new decentralized exchange for users on Polygon to enjoy fast transactions, high APRs on popular token pairings and a smooth experience with pro controls.

NachoSwap was built to support yield farming on Nacho Finance, and now that all swapping fees are within the ecosystem, a portion of revenue can be used to help peg health. The protocol’s portion of fees will be used to buy back and burn $NACHO, helping peg and overall project sustainability in the long run.

Along with NachoSwap, the project launches with high APRs on two of Polygon’s most popular pairs; MATIC-wETH LP and the wETH-USDC LP. These have some of the highest trading volumes on the network. But there’s more to this decision that just volume. We’ll get to that later in the story.

This is just phase 1 of NachoSwap. There are lots of enhancements and QOL improvements to make, and then we’re onto phase 2 with the integration of other DEXs and aggregators. Phase 3 will see the introduction of charts and analytics. This is just the start.

Providing liquidity to earn rewards.

NachoSwap operates as a non-custodial exchange, meaning the protocol doesn’t possess your tokens in order for them to be traded. Instead, a non-custodial exchange allows users to trade peer-to-peer with liquidity supplied by other users. Our liquidity pools allow anyone to provide liquidity, and in exchange they receive LP tokens. While these liquidity providers hold onto this token, the token can be farmed on Nacho Finance for rewards with insane daily APRs.

For example, if a user deposited $NACHO and $wETH into a pool, they would receive NACHO-wETH LP tokens. These ERC-20 tokens represent a proportional share of the pooled assets, allowing a user to reclaim their funds plus any accrued fees at any point. Every time another user uses the pool to trade between $NACHO and $wETH, the 0.30% fee is taken on the trade for NachoSwap.

So what makes up a NACHO LP Token? Assuming $NACHO is at peg, if there were 10 LP tokens representing 10 $ETH and 10,000 $NACHO, each token would be worth 1 $ETH & 1,000 $NACHO ($NACHOs peg is set to 1000:1 to $ETH).

Choosing the most attractive LPs.

There are countless pairs to offer, but we started with MATIC-wETH and wETH-USDC for their size, trading volume, stability and relatively low impermanent loss (IL), respectively.

For those unfamiliar (or unclear) with impermanent loss, it is defined as the change in asset value between the time you provide liquidity to a pool and the value in the current moment, or at the time of withdrawal. The bigger the change is, the more you’re exposed to impermanent loss of an asset’s changing value. This is why it’s important to get the best possible rewards on your liquidity pools, and part of why Nacho is offering high APRs on both of our new pools.

It doesn’t hurt that they have some of the highest trading volume on Polygon either. The other reason, as alluded to above, is to create payment rails, or liquidity rails.

An added benefit to adding MATIC-wETH and wETH-USDC is that it creates liquidity rails for our community, allowing users to swap from MATIC, wETH or USDC to both NACHO and NSHARE and vis versa in an efficient manner. This keeps Nacho users comfortably using NachoSwap and eliminates the need to use other DEXs to trade Nacho’s native tokens. This is good for liquidity, revenue, and project health.

Here’s a quick reference showing the various liquidity rails:

- MATIC > wETH > NACHO

- USDC > wETH > NACHO

- wETH > NACHO

- NSHARE > MATIC > wETH > NACHO

Providing liquidity is as easy as cheese.

Getting great rewards is quick. Here are the steps:

- Token balance: First, make sure you have a balance of tokens in your wallet proportional to the amount of LP tokens you wish to have. You can use NachoSwap to exchange tokens and optimize your balance.

- Provide liquidity: Adding liquidity is simple. Start by choosing the tokens that make-up the liquidity pool you’d like to contribute to. Click “Select Token” or click on an arrow to change the token you see if you’ve used NachoSwap before. You can also go to see which Farm or Auto-compounder you’d like to stake in and click the PROVIDE LIQUIDITY button to take you to the correct pair on NachoSwap. If you’re new to NachoSwap, you’ll have to approve the tokens first. Always remember to confirm the selected tokens.

- Receive LP tokens: When the liquidity adding is done, you will receive LP tokens in return. These represent your share in the liquidity pool and can be seen in your wallet as a unique UNI V2 token.

- Farm your tokens: Now go to the respective farm and deposit the LP tokens. You can choose to deposit any amount of them and confirm.

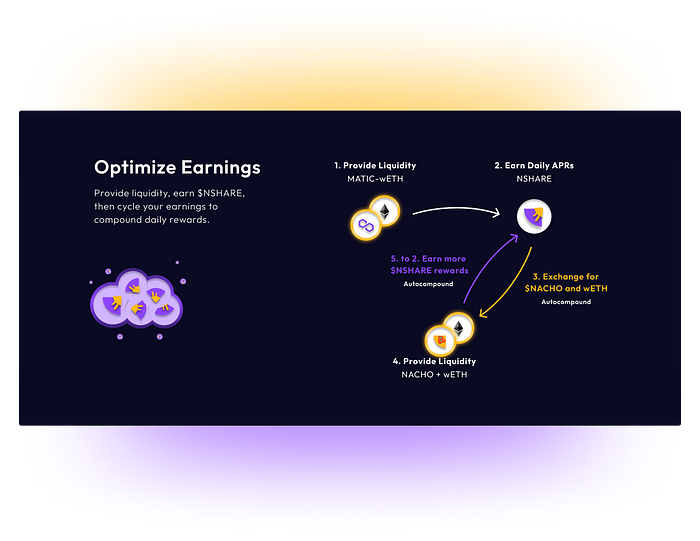

- Earn & return: As you start to receive your $NSHARE rewards, you can go back to NachoSwap, trade them for $NACHO and $wETH, provide liquidity to that native liquidity pool, and receive the highest rewards on all of Nacho. This is the power of compound interest. Nacho’s auto-compounder can make this easy by automating the actions for you. You just sit back, LP & chill.

Making rewards juicier with auto-compounding.

Along with the addition of NachoSwap, we’ve launched our very own auto-compounder. It’s simple, you just take LP tokens that you’ve paired on NachoSwap and stake them in the auto-compounder just like you would have for the farms.

The auto-compounder does all the work for you. On a 6-hour cycle, it automatically claims your rewards, trades them for equal parts of the liquidity pool tokens, pairs them, and re-stakes. It makes fast work of your token compounding efforts.

For example, consider a 3% daily APR on an initial investment of $100.

- After 24 hours it would grow to $103.

- After 365 days, without compounding: $1195.

- After 365 days, compounding once daily: $4,848,272.

As Einstein said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays for it.”

And the fees are free on the native liquidity pools. Soon, we’ll be launching auto-compounding for the new LPs.

New products, new revenue, good for $NACHO.

Why is this all good for Nacho and the $NACHO token? Simple; revenue for the treasury. Growing an ecosystem requires resources, specialists, and takes a lot to feed. A healthy treasury keeps the project building, growing, and improving.

And of course, revenue helps to achieve protocol owned liquidity, an important goal for Nacho.